Sub-Contractors

Please read Payroll Cut-Off Details (PDF) for details on our pay dates, and when invoices need to be submitted. Deadline for invoices is 8am on the 10th and 25th for pay on the 15th and 1st (or next banking day). Cutoff for work completed is the 10th and 25th by end of business day. If you include work not completed, it will be reviewed by the office and the scheduling department.

If this is your first payroll with Rob’s Drywall, click here to create your site docs account, set up banking, view our safety documentation, complete job hazard assessments, and other forms.

Quick Links

Instructions for invoicing:

- Click “Create Invoice”.

- Fill in all the requested information. All boxes marked with an * are required each time you invoice.

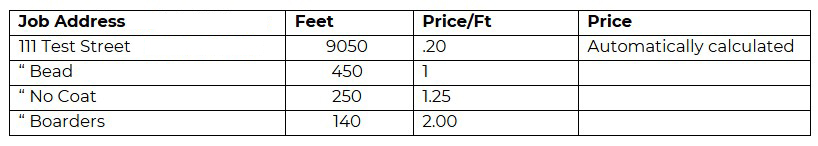

- Complete “Job Address, Feet and Price/FT”.

**Please ensure this amount matches your work order** - The last column “Price” will calculate for you.

- The “Subtotal, GST and Total” will also automatically calculate.

- Click on the box beside either “Boarder, Taper or Other”.

- The “Material and Net Payroll” will be calculated at the office.

- Please use multiple addresses per invoice. We do NOT require a separate invoice per job/address you complete.

- Click “Submit” and a copy of your invoice will appear. It will automatically be sent by email to you and our office.

- Please PRINT a copy for your records if you require.

- If you have any questions please call the office at 403-275-8471.

Other information:

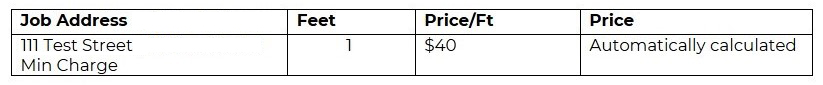

For minimum charges or flat rates: Please include the address and “min. charge” in the Job Address column, enter a 1 for the Feet column, and enter the cost in the Price/Ft column.

For Example entries, please see the following:

For tapers or subcontractors with multiple lines per address: Please enter the address on the first line, use ” to denote “same as above” and just put the description in the job address column for no coat, arches, boarders, etc.